| Hana Kubickova

Feb 24, 2022 Thu 9:00 AM -10:30 AM EST (Washington DC time), 15:00 PM - 16:30 PM CET

Click here to convert to your local Time

WebEx (information enclosed below)

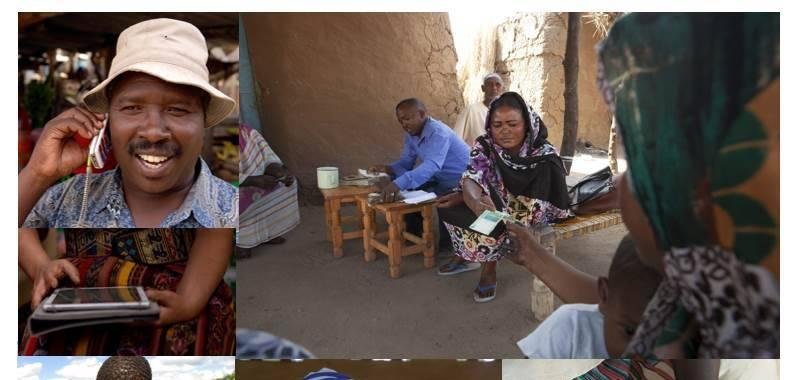

Digitalization and access to data in rural areas have been crucial in the design and delivery of a new generation of financial services including a diversity of credit, savings, payments, remittances, insurance which can reach rural poor people as they build livelihoods and confront economic, environmental, and social challenges. Digital financial services and innovative technologies can provide a comparative advantage especially for expanding outreach to unbanked/remote communities and reducing the cost of financial intermediation. While there has been an unprecedented growth of digital financial services in Africa with almost half of 700 million overall users worldwide driven primarily by mobile money; further scaling other financial services would require a range of support from new or updated national financial sector policies, enabling regulatory frameworks, infrastructure investments and digital literacy.

Improved means to gather and safely assess poor rural people’s credit profile continues to be a notable barrier to increased access, as is the need to de-risk financial services through digital innovations, financial literacy and an appropriate mix of products and services tailored to meet the needs of rural clients. Meeting these challenges will be critical for inclusive and sustainable rural and food system transformation.

In this context, remittances have a leading role to play in promoting financial inclusion and livelihood development in rural communities. Many millions of households in Africa have benefited from remittances from family and friends with almost 65% increase in mobile payments and remittances in 2020 itself. Similarly, diaspora investments can also have a positive impact to foster investments and promoting increased access to financial services in rural communities. As focus and interest in remittances to Africa increase, the resilience of these financial flows during the pandemic has highlighted once more the need to intensify efforts to unleash their impact to development. While opportunities to scale remittance services are high, challenges remain, including improving infrastructure, expanding digitalization, better data collection, supportive policies, and public-private investments.

Opening remarks: Parmesh Shah, Global Lead, Data-Driven Digital Agriculture, Agriculture and Food Global Practice, The World Bank

Keynote speaker: Thouraya Triki, Director, Sustainable Production, Markets and Institutions Division (PMI), IFAD

Panel discussion:

- Pedro De Vasconcelos, Senior Technical Specialist, Coordinator, Financing Facility for Remittances, PMI, IFAD

- Nika Naghavi, Director, Strategic Projects, MFS Africa

- James Marc Sousa-Shields, Lead Regional Technical Specialist, Rural Finance and Markets, PMI, IFAD.

- MasterCard Centre for Inclusive Growth (TBC)

Closing remarks: Hakima El Alami, Director, Payment Systems and Instruments Oversight and Financial Inclusion, Bank Al Maghrib (Central Bank of Morocco)

Moderator 1: Gladys H. Morales, Senior Innovation Adviser, Change Delivery and Innovation Unit (CDI), IFAD

Moderator 2: Brenda Gunde, Senior Technical Specialist, ICT4D, PMI, IFAD

1-650-479-3207 Call-in toll number (US/Canada) |

|